Your Health Idaho Coverage Guide

Updated January 5, 2026

Getting Started and Managing Paperwork

Helpful Tips

Know the Password for Your Insurance Company Account

Creating an online account with your health insurance company ensures you have easy access to important policy documents and information about your coverage. You will also be able to access other features offered by your insurance company, such as being able to make payments. To guarantee you can access your account when you need it most, make sure you know your account password.

Check Your Secure Your Health Idaho Inbox Regularly

You’ll receive important information and documents regarding your health insurance enrollment from Your Health Idaho in your account inbox. It’s important to check your inbox regularly to have access to important information and to ensure you don’t miss deadlines.

Be Mindful of Deadlines

When it comes to health insurance, paying attention to deadlines is crucial to receive and maintain the health coverage you need. Missing deadlines can result in changes such as the loss of a tax credit.

Ten Essential Health Benefits

All plans offered through Your Health Idaho meet the high standards of state and federal requirements and are required to cover ten essential health benefits, including:

- Doctor Visits

- Hospitalization

- Emergency Services

- Mental Health & Substance Abuse Services

- Rehabilitative & Habilitative Services

- Laboratory Tests

- Prescription Medicine

- Preventive Wellness & Screenings

- Pediatric Care

Preventive Services

A visit to the doctor shouldn’t only be for when you’re feeling under the weather. One of the most important ways you can safeguard your health and well-being is by taking advantage of preventive health services. By scheduling check-ups and getting the appropriate health screenings, you can identify health issues early on when they may be easier to treat. In the long run, preventative services can save you time, money, and discomfort.

Preventive care benefits that you may have access to may include:

-

-

- Breast cancer mammography: Every two years for women 50 and over, as recommended by a provider for women 40-49 at higher risk for breast cancer

- Counseling and education

- Immunizations

- Pap test for women

- PrEP (pre-exposure prophylaxis)

- Screenings for the following: Diabetes, Cholesterol, Colorectal Cancer, HIV, Lung Cancer, Obesity, Alcohol Misuse, UTI, Depression, and more

-

Talk to your doctor to learn which preventive services are right for you. These services are only covered when delivered by a provider in your plan’s network.

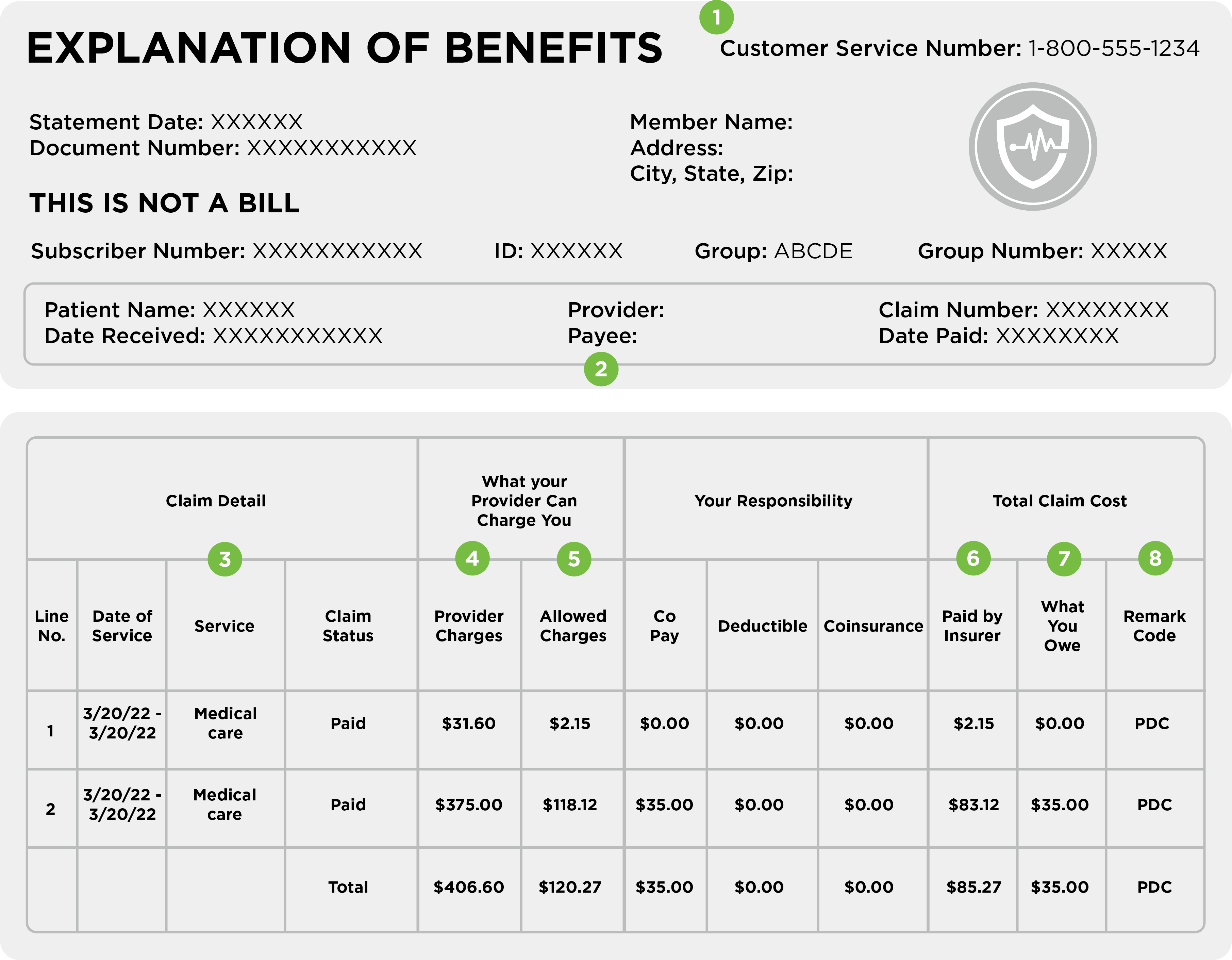

How to Read Your Explanation of Benefits

After a visit to your provider, you may receive an Explanation of Benefits (EOB). This document will outline the total cost of your visit, what is paid by your health insurance, and how much you may owe. An EOB is NOT a bill. You may get a separate bill from the provider.

Claim Details

This section of your EOB will summarize the costs of your visit(s). You may see multiple claims in this portion.

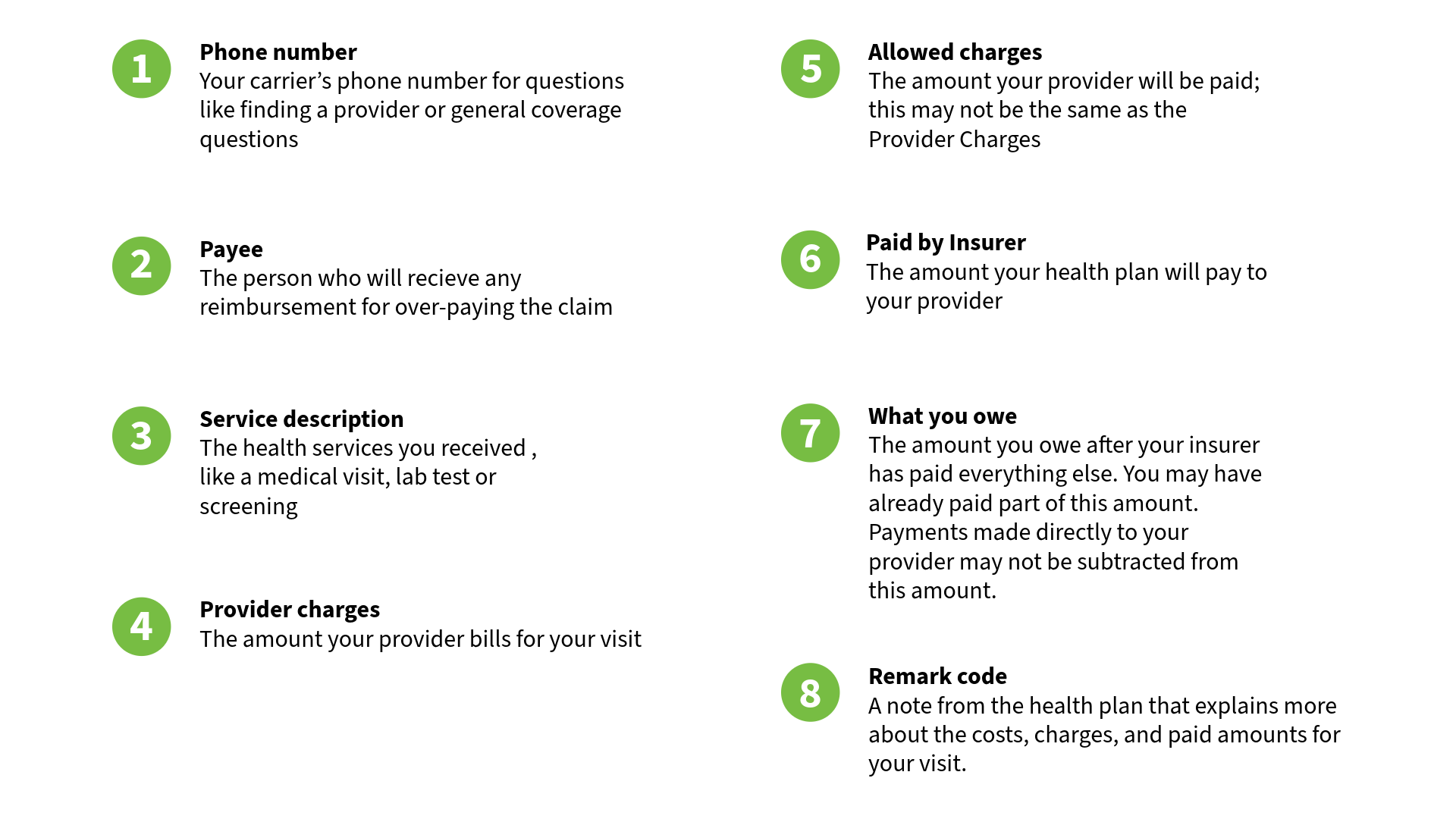

How to Read a Summary of Benefits and Coverage

A Summary of Benefits and Coverage (SBC) document provides an overview of your health plan’s benefits, coverage, and limitations and exceptions. The SBC may help you compare plans and provides examples of what type of coverage would be received in common medical situations. You can refer to your SBC when renewing a plan or to better understand your current coverage options and possible cost-sharing expenses.

Header

In this section you’ll find the insurer’s name, the official plan name, coverage period, who the plan covers, and plan type. Double-check the information in this area to make sure you’ve received the correct SBC.

Box Above Important Questions Chart

Defines the purpose of the SBC, includes carrier website link, and information on where you can access a glossary defining common insurance terms.

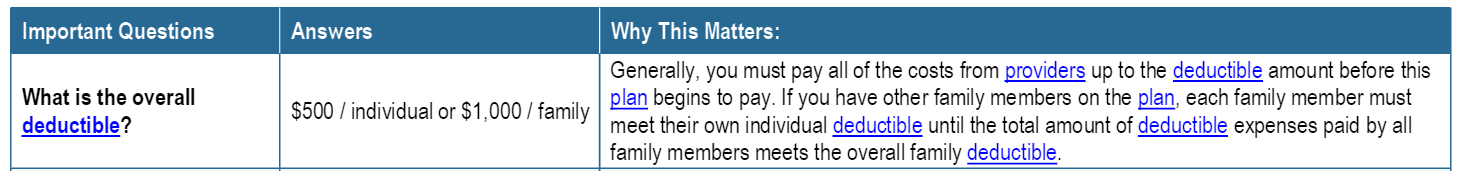

Important Questions Charts

Provides information about the cost of the health plan, including information on the deductible(s), referral requirements, out-of-pocket limits, and provider networks.

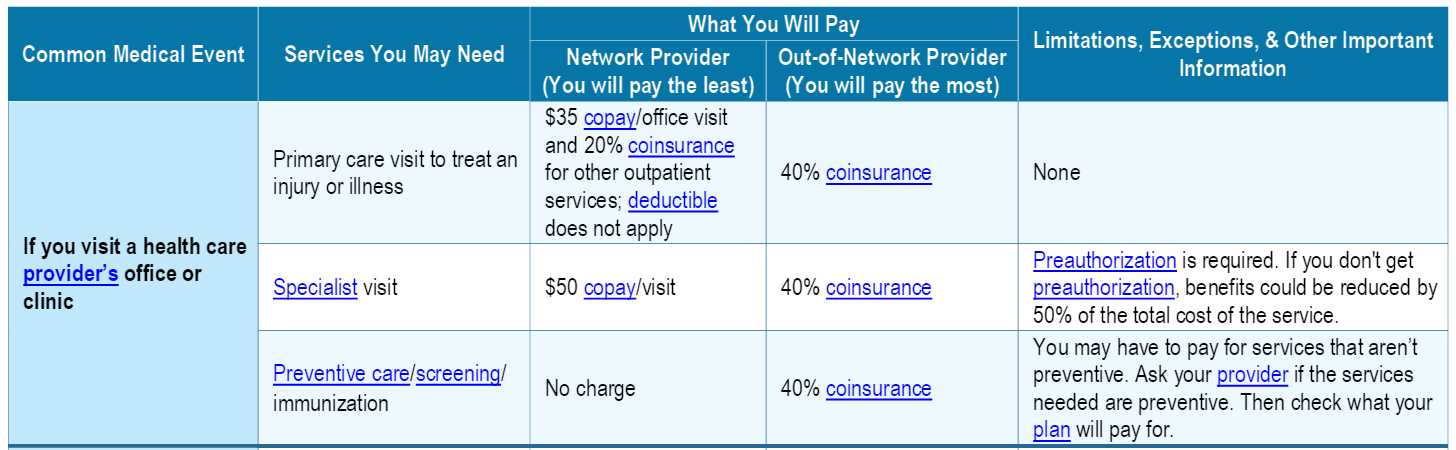

Common Medical Events Chart

Outlines the costs of specific medical visits and procedures under the plan. Expenses for common medical service types are grouped together and what you pay for each type of care is provided. This section will also show you costs for services by in-network and out-of-network providers. The limitations, exceptions, and other important information columns will provide details about service requirements and cost variance.

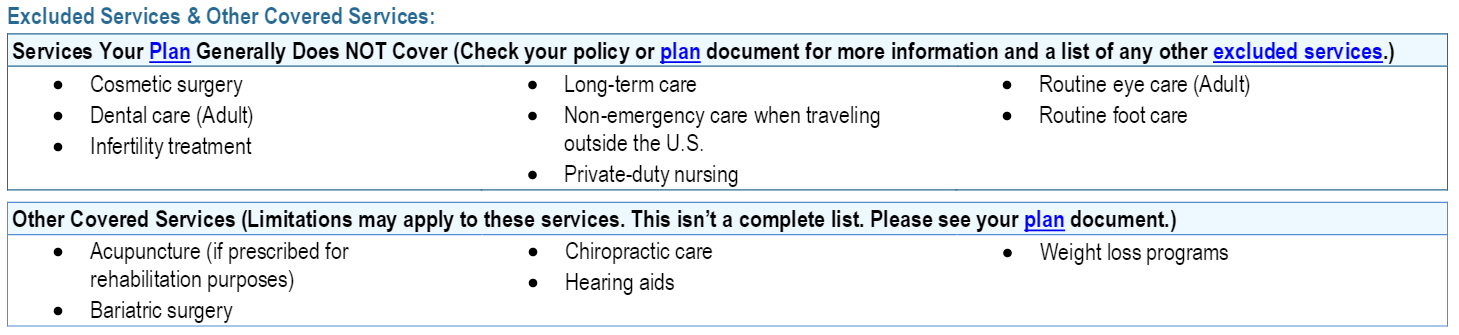

Excluded Services and Other Covered Services

This section includes:

-

- Services the plan does not generally cover

- Other covered services that don’t fit into the “Common Medical Events” chart but are still common. This is not an exhaustive list.

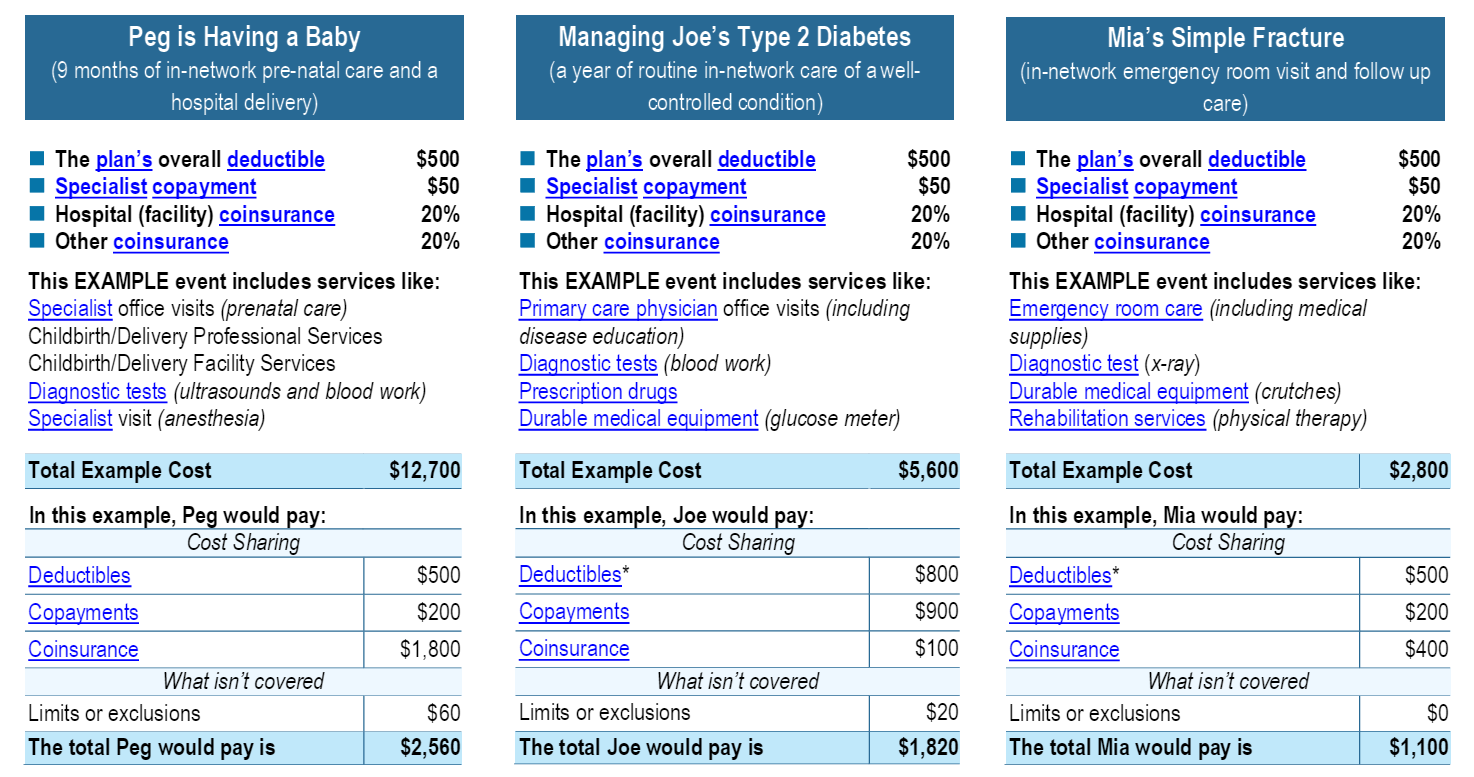

Coverage Examples

Each SBC provides examples of scenarios of how a procedure or treatment would be covered by the health insurance plan, and how much you would have to pay. These examples may not reflect the actual costs for services.

Consumer Protection

The content in this section details your rights, if the plan meets requirements for Marketplace insurance, and describes how to file a complaint. It is there for your protection.

Your Health Idaho-Certified Agents and Brokers

Benefits of Working with an Agent or Broker

Navigating the complexities of health insurance is no easy feat. Whether it’s your first time applying for coverage or you’ve done it many times, the process can be overwhelming.

The good news—you don’t have to do this alone.

Your Health Idaho is all about simplifying the process and helping you select the right plan for you and your family. We partner with agents and brokers who are licensed and in good standing with the Idaho Department of Insurance.

Help Selecting a Plan Tier

Agents and brokers can provide guidance on which metal tier for plans may be more cost-effective for you in the long run. They can also assist you in determining your eligibility for Cost-Sharing Reductions, which are additional health insurance discounts.

Enrollment counselors are available as well. Although enrollment counselors can assist you with the application process and applying for a tax credit, they can’t make recommendations about which plan to buy. That’s because they’re not licensed with the Department of Insurance. If you’re working with an enrollment counselor, they’ll refer you to an agent or broker when it’s time to select a plan.

Consumer Connectors Provide No-Cost Assistance

Those agents, brokers and enrollment counselors are called Consumer Connectors, and they can help you navigate the process, at no cost to you.

All Consumer Connectors receive specialized training to assist Idahoans who are purchasing health coverage through Your Health Idaho. With over 1,000 Consumer Connectors across the state, many of whom are bilingual, there is someone to help you with your health insurance needs.

Consumer Connectors are ready to walk you through the application process, assist in applying for a tax credit, and help you choose a plan that fits your budget.

Additional benefits of working with a Consumer Connector include:

- Ensuring you don’t miss important dates

- Assistance reporting changes to your account

- Help with any questions or concerns you have about your health coverage

- Assistance in your preferred language

- Guidance on making changes during renewals

- Support during the application process, ensuring you receive an accurate tax credit

- A feeling of security, as all Consumer Connectors are up to date on Your Health Idaho’s policies and procedures

Finding a Consumer Connector

How do you find a Your Health Idaho-certified Consumer Connector? Visit our No-Cost Assistance page, enter your zip code and search distance. You’ll see a list of experts in your area. You can also find a Consumer Connector by contacting our Customer Support Center at 855-944-3246 or by going to YourHealthIdaho.org to chat with live support.

Keeping Your Agent Updated

To ensure your Your Health Idaho-certified agent can provide the best assistance, remember to keep them updated. Inform them about any notices you receive, and any changes that occur in your household or your income that could affect your eligibility for coverage through Your Health Idaho.

Understanding Important Terms

Understanding common insurance terms is essential for making informed health decisions. Below are some key terms you’re likely to encounter.

Health Insurance Terms

Adjusted Gross Income

A person’s total income for the year, minus certain adjustments.

Agents/Brokers/Enrollment Counselors

Trained professionals who can help assist consumers with their health insurance enrollment. There is no cost to use their services.

Allowed Amount

The maximum amount your health plan will pay for a covered healthcare service.

Balance Billing

When the cost for a healthcare service is greater than what is allowed by your plan, you may have to pay the difference.

For example, if the cost for a healthcare service is $100 and the allowed amount is $80, your provider may bill you for the remaining $20.

Binder Payment

The first initial payment to your health insurance carrier completes your enrollment. If you fail to pay your first month’s premium, your policy will not take effect and you will not be enrolled in coverage.

Co-insurance

The percentage you pay for covered health services after your deductible is met. Your health insurer or plan pays the rest of the allowed amount. Depending on your plan, your portion of the co-insurance could range from 20-40%.

Co-payment

The fixed amount you pay for a medical visit or medication, e.g., $15 per visit, is usually paid at the time you receive the service. This is considered part of your out-of-pocket costs, separate from premiums and deductibles. This may vary by the type of health care services being provided.

Deductible

The amount you must pay for health care services during a coverage year before your health insurance carrier starts covering costs. For example, if your plan has a deductible of $1,000, you will have to pay for any covered healthcare services that are subject to the deductible until you reach the $1,000 amount. After that, your plan will start covering costs according to your plan benefits. The deductible may not apply to all services.

Dependent

A person who is eligible for coverage under a policyholder’s health insurance plan. A dependent may be a spouse, domestic partner, or child. In some cases, you may also be able to cover a grandchild, an adult child with a disability, a foster child or someone for whom you are the legal guardian.

Emergency Medical Condition

An illness, injury, symptom (including severe pain), or condition severe enough that it requires immediate medical attention.

Emergency Medical Transportation

Ambulance services for an emergency medical condition. Your plan may include transportation by air, land, or sea.

Emergency Room Care/Emergency Services

Services provided to treat an emergency medical condition. Services may be provided in a licensed hospital’s emergency room or any location providing emergency medical services.

Excluded Services

Healthcare services that your plan does not cover or pay for.

Explanation of Benefits

A document that outlines the costs of a visit, what your health insurance policy covers, and how much you may owe. This is not a bill.

Habilitation Services

Healthcare services that help you keep, learn, or improve skills and functioning for daily living.

e.g., therapy for a child who isn’t walking or talking at the expected age or someone recovering from a stroke. May be inpatient or outpatient services.

Hospital Outpatient Care

Care in a hospital that does not require an overnight stay.

Hospitalization

Admission to a hospital as an inpatient that usually requires an overnight stay.

In-Network

Physicians, hospitals, or other healthcare providers your health insurer has contracted with to provide your health services. You may pay less when receiving in-network healthcare.

Medically Necessary

Healthcare services that are provided to a patient to prevent, evaluate, or diagnose an illness, injury, condition, disease, or its symptoms. Services deemed medically necessary must meet recognized standards of medicine.

Modified Adjusted Gross Income

The figure used to determine eligibility for premium tax credits and other savings for Marketplace health insurance plans.

Network

Providers, healthcare facilities and suppliers who have contracted with your insurance company to provide services.

Non-Preferred Provider

A provider who does not have a contract with your insurance carrier. You may pay more to see a non-preferred provider.

Out-of-Network

Physicians, hospitals, or other healthcare providers your health insurer has not contracted with to provide your health services. Costs for out-of-network healthcare are typically higher.

Out-of-Pocket Costs

Medical Expenses that aren’t covered by your insurance plan. Out-of-pocket costs include deductibles, co-insurance, co-payments, and charges for services not covered.

Out-of-Pocket Maximum/Limit

The most you’ll pay for covered services within a coverage year. After you reach this max limit your health plan will pay for 100% of the costs.

Out-of-pocket limit does not include:

-

- Your monthly premium

- Out-of-network care and services

- Anything spent on services your plan doesn’t cover

- Costs above the allowed amount for a service that a provider may charge

Preauthorization

A health care service, treatment plan, prescription drug or use of medical equipment that must be approved as medically necessary by your health insurer. This may be required for certain services before you receive them. Preauthorization doesn’t guarantee your health insurance will cover the cost.

Pre-Existing Condition

Any health problem like asthma, diabetes, or cancer you had before the date new health coverage starts. You cannot be denied coverage through Your Health Idaho due to a pre-existing condition.

Preferred Provider

A physician or doctor who has a contract with your health insurance company to provide services at a discounted rate.

Premium

The amount you pay for your health insurance every month.

Prescription Drug Coverage

Health insurance or plan that helps pay for prescription drugs and medications.

Primary Care Physician/Provider

Doctor or healthcare specialist who provides, coordinates, or helps a patient access a range of health care services.

Provider

A health professional or facility licensed to provide health care. Doctors, nurses, hospitals, and specialists are examples of health care providers.

Specialist

A physician or provider that focuses on a specific area of medicine or health care.

Urgent Care

An illness, injury, symptom (including severe pain), or condition that is serious enough for a person to seek care right away but does not require emergency room care.

Marketplace Insurance Terms

Advance Premium Tax Credits (APTC)

A tax credit that acts as an instant discount to cover some or all the monthly costs for health insurance coverage. The tax credit amount will depend on income level, household size, and other factors.

Cost-Sharing Reductions

A discount that lowers the amount you pay out-of-pocket for things like deductibles, co-insurance, and co-payments. To qualify for a CSR your income must be within a certain range of the Federal Poverty Level (FPL) and you must be enrolled in a Silver Tier Plan.

Essential Health Benefits

Under the Affordable Care Act, health insurance plans purchased through a state-based marketplace must cover a set of 10 categories of services; some plans may cover more.

All plans offered through Your Health Idaho cover at least the following: Doctor Visits, Hospitalization, Emergency Services, Mental Health & Substance Abuse Services, Rehabilitative & Habilitative Services, Maternity & Newborn Care, Laboratory Test, Prescription Medicine, Preventive Wellness & Screenings, Pediatric Care

Federal Poverty Level (FPL)

The Guideline issued by the Department of Health and Human Services that determines eligibility for various income-based public programs.

Idaho Department of Health and Welfare

State agency that administers state and federal public assistance and health coverage programs.

Medicaid

Government program that provides health insurance for adults and children with limited income and resources.

Medicare

Federal health insurance program for adults 65 or older, and certain younger people with disabilities.

Minimum Essential Coverage

Any insurance plan that meets the Affordable Care Act requirement for having health coverage is sometimes called “qualifying health coverage.” All plans sold through Your Health Idaho meet the requirements.

Open Enrollment

The period from October 15 to December 15 each year when Idahoans can enroll in health insurance plan for the coming year. During Open Enrollment, Idahoans already enrolled with Your Health Idaho can make changes or renew their existing coverage.

Qualified Health Plan

A health insurance plan certified by Your Health Idaho provides the ten essential health benefits, follows established limits on cost-sharing (like deductibles, co-payments, and out-of-pocket maximum amounts), and meets other requirements.

Qualified Dental Plan

A dental insurance plan that helps pay for the cost of dentist visits for basic or preventive services like teeth cleaning, X-rays, and fillings. In the Marketplace, dental coverage is available either as part of a comprehensive medical plan or as a “stand-alone” dental plan.

Qualifying Life Event

A change in your life that can make you eligible for a Special Enrollment Period, allowing you to enroll in health coverage outside of Open Enrollment. Examples of qualifying life events are moving to or within Idaho to a new rating area, changes in your income, loss of employer-sponsored coverage, and changes in your family size e.g., marriage or having a baby).

Reconcile

The process used to confirm you received the correct American Premium Tax Credit amount during the year. You reconcile your tax credit by using your Form 1095-A to fill out Form 8962 with your federal tax return.

Second Lowest Cost Silver Plan (SLCSP)

The second-lowest priced health insurance plan in the Silver category that applied to you. The SLCSP is used to calculate your final premium tax credit. You do not have to be enrolled in this plan.

Special Enrollment Period

A time outside of the Open Enrollment Period during which you and your family can enroll in health coverage. To qualify for a Special Enrollment Period, you must experience a Qualifying Life Event.

Tax Filing Requirement

The minimum amount (or threshold) of income requiring you to file a federal tax return.

Preparing for Tax Season

Why You Need to File Your Federal Return Every Tax Season

If you purchased health insurance through Your Health Idaho and received an Advance Premium Tax Credit (APTC), you’re required to file your federal tax return to validate or reconcile the amount of tax credits you received during the year. This ensures you received and used the correct credit amount based on your actual income at the end of the year.

Congressional action in 2025 makes annual reconciliation mandatory for every consumer who receives a tax credit. Failure to reconcile annually will result in the loss of APTC eligibility for the following plan year.

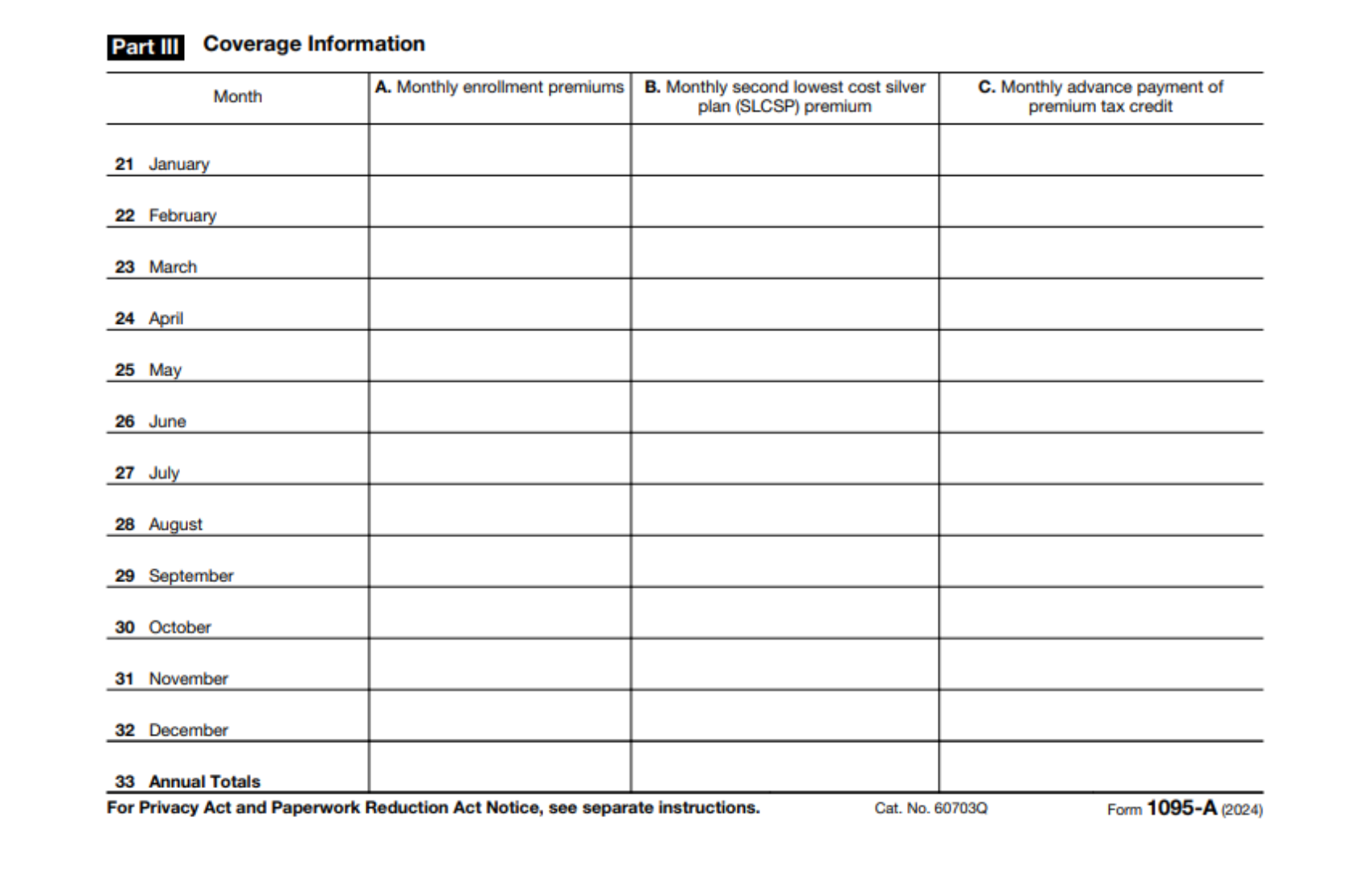

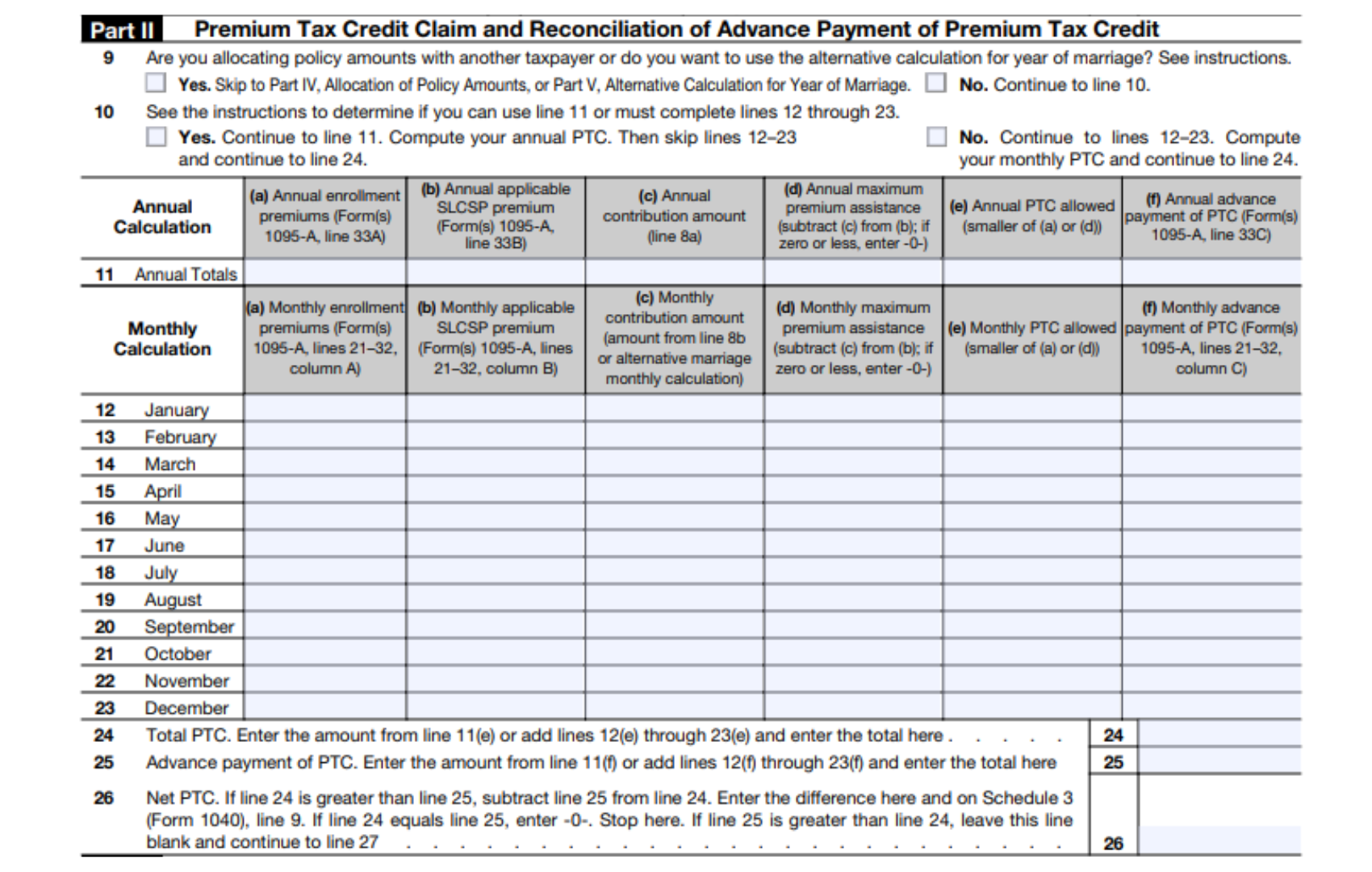

To reconcile your credit this tax season, use Form 1095-A: Health insurance Marketplace Statement to fill out Form 8962: Premium Tax Credit.

How to Access Your Form 1095-A

You’ll receive Form 1095-A: Health Insurance Marketplace Statement from Your Health Idaho. This form is sent to your Your Health Idaho secure inbox and the IRS by January 31. If you opt to receive a print copy, it will also be sent to you via U.S. mail.

Your 1095-A includes information about your health coverage received through Your Health Idaho, including:

-

- Household members enrolled in a health plan

- How long each household member had health insurance during the year

- The cost of your monthly health insurance premiums

- The amount of Advance Premium Tax Credit (APTC) received each month

A 1095-A form will be sent for each household member enrolled in a separate health insurance plan through Your Health Idaho. You will also receive multiple 1095-As if you switched plans during the year.

To Download a Copy of Your 1095-A From Your Secure Your Health Idaho Inbox

-

-

- Log in to your account on YourHealthIdaho.org.

- Click My Inbox in the My Stuff

- Click the From or Subject link to view a notice. The 1095-A notice is named Form 1095A for [your insurance company].

- In Attachments, select the file name to download the form.

- Download all 1095-A tax forms for the year in your inbox.

-

(To Reset Your Password, Click Here for Help)

If you check your 1095-A tax statement and find an error, contact Your Health Idaho at 855-944-3246. If there is an error, you’ll receive a corrected 1095-A tax statement. Do not file your taxes until you have an accurate form 1095-A for all members of your household.

How to Complete Your Form 8932 and Reconcile Your Tax Credit

Once you receive your 1095-A form, you will use the information on the document to complete part II of Form 8962: Premium Tax Credit.

If you find an error with your 1095-A form, contact Your Health Idaho for help at 855-944-3246.

Part III of Form 1095-A. Use this section to fill out Form 8962

Part II of Form 8962. You will use Part III of your 1095-A to fill out this section.

File Form 8962 With Your Federal Return This Tax Season

-

-

- Attach Form 8962 when you file your federal tax return. Be sure to keep your 1095-A for your records.

-

Refer to this IRS Guide to learn how to correct an electronically filed return rejected for missing Form 8962.

For help filling out Form 8962 or submitting your tax return, please contact an accountant, tax preparer, or visit www.IRS.gov.

NOTE: Form 1095-A is not required for catastrophic or stand-alone dental plans.

The IRS website has several resources to help you file your taxes. Learn more with the IRS Guide to Community-Based Free Tax Preparation.

General Information

Why It’s Important to Report Changes

When changes in your household or financial situation happen, it is important to report those changes to Your Health Idaho as soon as possible. Reporting changes as they occur ensures you receive the correct amount of tax credit.

-

-

- Your changes may qualify you for a different tax credit than you currently have. If these changes go unreported, you may have to pay back money when you reconcile your tax credit and file your federal tax return.

- Your changes may qualify you for more savings, meaning you could lower your monthly health insurance payments or could become eligible for Medicaid.

-

What Type of Changes Should I Report?

Report a change if you experience:

-

-

- Change of household size

- Change in income

- Change of Marketplace Eligibility (eligible for coverage elsewhere)

- Change of address

- Other special circumstances

-

How to Report a Change

To report a change log in to your household’s Your Health Idaho account and follow the steps on the dashboard to edit your application. If you need help, contact the Your Health Idaho customer support team at 855-944-3246 or a Your Health Idaho-certified agent.

Qualifying Life Events

If someone you know misses the Open Enrollment window, they’re not out of options. Idahoans who experience a Qualifying Life Event, such as marriage, the birth of a child, or the loss of employer coverage, may qualify for a Special Enrollment Period. The Special Enrollment Period allows individuals and families to enroll in health insurance coverage outside of Open Enrollment.

After experiencing a Qualifying Life Event, you have 60 days from the date of your event to enroll in a plan with Your Health Idaho.

Contact Your Health Idaho at 855-944-3246 with questions or assistance.

Special Enrollment Periods

To enroll in health coverage through Your Health Idaho during a Special Enrollment Period (SEP) an application will need to be filled out and submitted at yourhealthidaho.org. If you need assistance with your application, contact our Customer Support Center at 855-944-3246. A Your Health Idaho-certified agent is also available to help you through the process.

If you are a member of a federally recognized tribe, you can enroll or change plans once a month through Your Health Idaho.

Renewals or Redeterminations

When you purchase health coverage through Your Health Idaho, you will automatically be reenrolled into the same or comparable health insurance plan the following year. If you have any questions about renewals, please contact our Customer Support Center at 855-944-3246 or a Your Health Idaho-certified agent.

Why and How to Disenroll From Your Plan

There are instances where you may need to disenroll from a health insurance plan purchased through Your Health Idaho. These instances include:

-

-

- Divorce

- Death of enrollee

- Out of state move

- Gaining Medicaid or Medicare

- Gaining employer-sponsored affordable coverage

-

To disenroll from health coverage please contact Your Health Idaho’s Customer Support Center at 855-944-3246, or a Your Health Idaho-certified agent.

Cancel Your Plan

To terminate your health insurance plan, you must cancel your enrollment within 10 days of the coverage effective date. This window is called the 10-day Lookback.

Reasons to cancel your policy include:

-

-

- Gaining employer-sponsored coverage or other affordable coverage

- Becoming eligible for Medicaid or Medicare

- Reassessing coverage and deciding not to continue with the policy

-

If you fall within the 10-day Lookback you can cancel your policy by calling Your Health Idaho’s Customer Support Center at 855-944-3246.

Plan Benefits

If you have any questions about your health plan benefits, contact your health insurance carrier.

Medicaid or CHIP

For any questions regarding Medicaid or CHIP eligibility please contact the Department of Health and Welfare at 877-456-1233 or visit HealthandWelfare.Idaho.gov.

General Questions

If you have any general questions about your health insurance enrollment through Your Health Idaho, please contact our Customer Support Center at 855-944-3246 or visit Yourhealthidaho.org to chat with a Consumer Advocate. If you need additional assistance understanding a health insurance plan, a Your Health Idaho-certified Consumer Connector can guide you through a policy, at no cost.