Tax season is officially here! Idahoans who purchased health insurance through Your Health Idaho and received an Advance Premium Tax Credit (APTC) are required to file their federal income tax.

Why do I need to file my federal income tax?

An income tax must be filed to validate or reconcile the amount of tax credits received during the year. This ensures you received and used the correct tax credit amount based on your actual income at the end of the year.

To reconcile tax credits, use Form 1095-A: Health insurance Marketplace Statement to fill out Form 8962: Premium Tax Credit.

Access your Form 1095-A

You’ll receive Form 1095-A: Health Insurance Marketplace Statement from Your Health Idaho. This form is sent to your Your Health Idaho secure inbox and the IRS by January 31. If you opt to receive a print copy, it will also be sent to you via U.S. mail.

Your 1095-A includes information about your health coverage received through Your Health Idaho, including:

-

- Household members enrolled in a health plan

- How long each household member had health insurance during the year

- The cost of your monthly health insurance premiums

- The amount of Advance Premium Tax Credit (APTC) received each month

To download a copy of your 1095-A from your secure Your Health Idaho inbox:

-

- Log in to your account on YourHealthIdaho.org.

- Click My Inbox in the My Stuff

- Click the From or Subject link to view a notice. The 1095-A notice is named Form 1095A for [your insurance carrier].

- In Attachments, select the file name to download the form.

- Download all 1095-A tax forms for the year in your inbox.

If you need to reset your password, click here for help.

A 1095-A form will be sent for each household member enrolled in a separate health insurance plan through Your Health Idaho.

How to Complete your Form 8932 and reconcile your tax credit

Once you receive your 1095-A form, you will use the information on the document to complete part II of Form 8962: Premium Tax Credit.

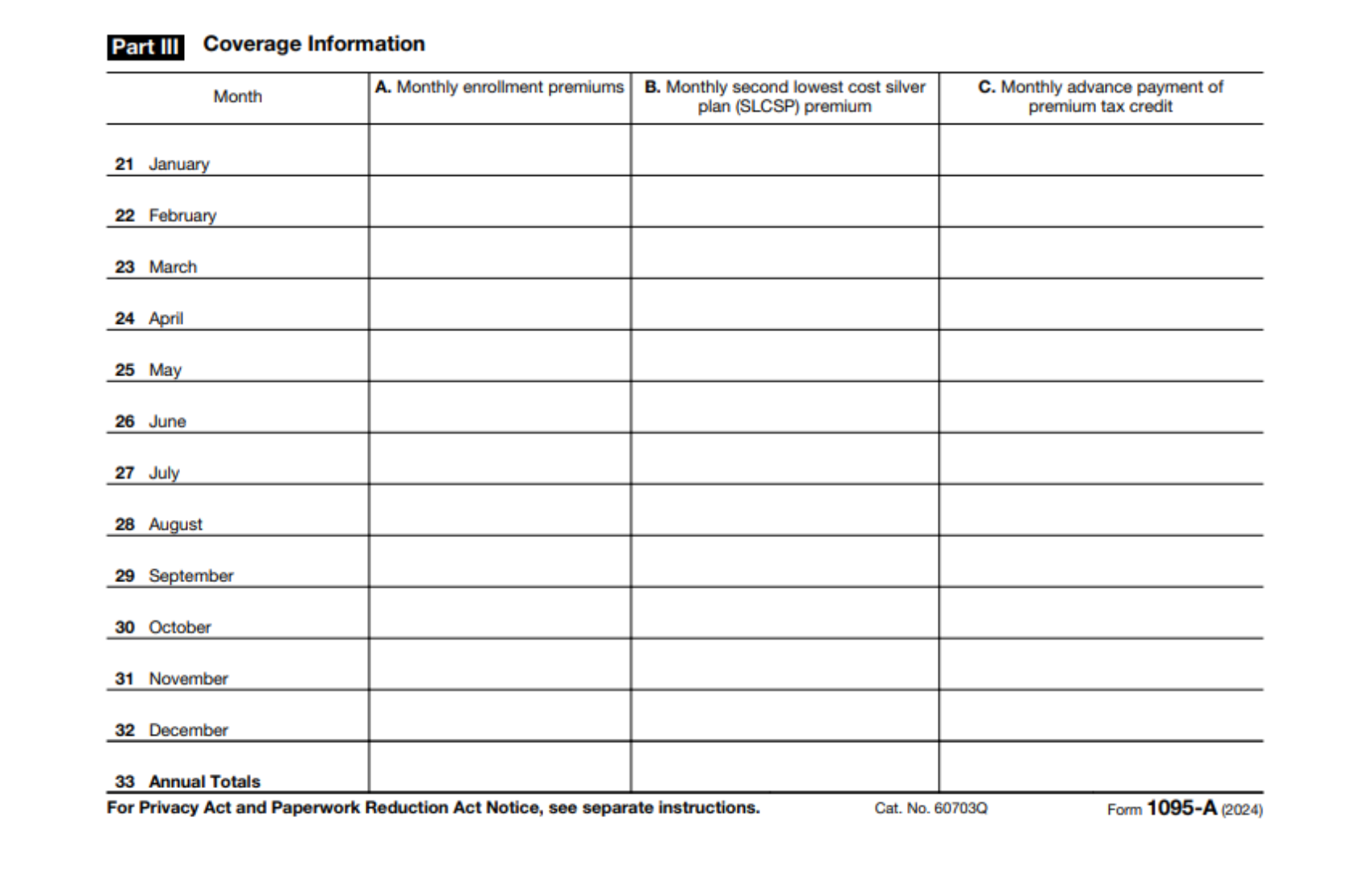

Part III of Form 1095-A. Use this section to fill out Form 8962

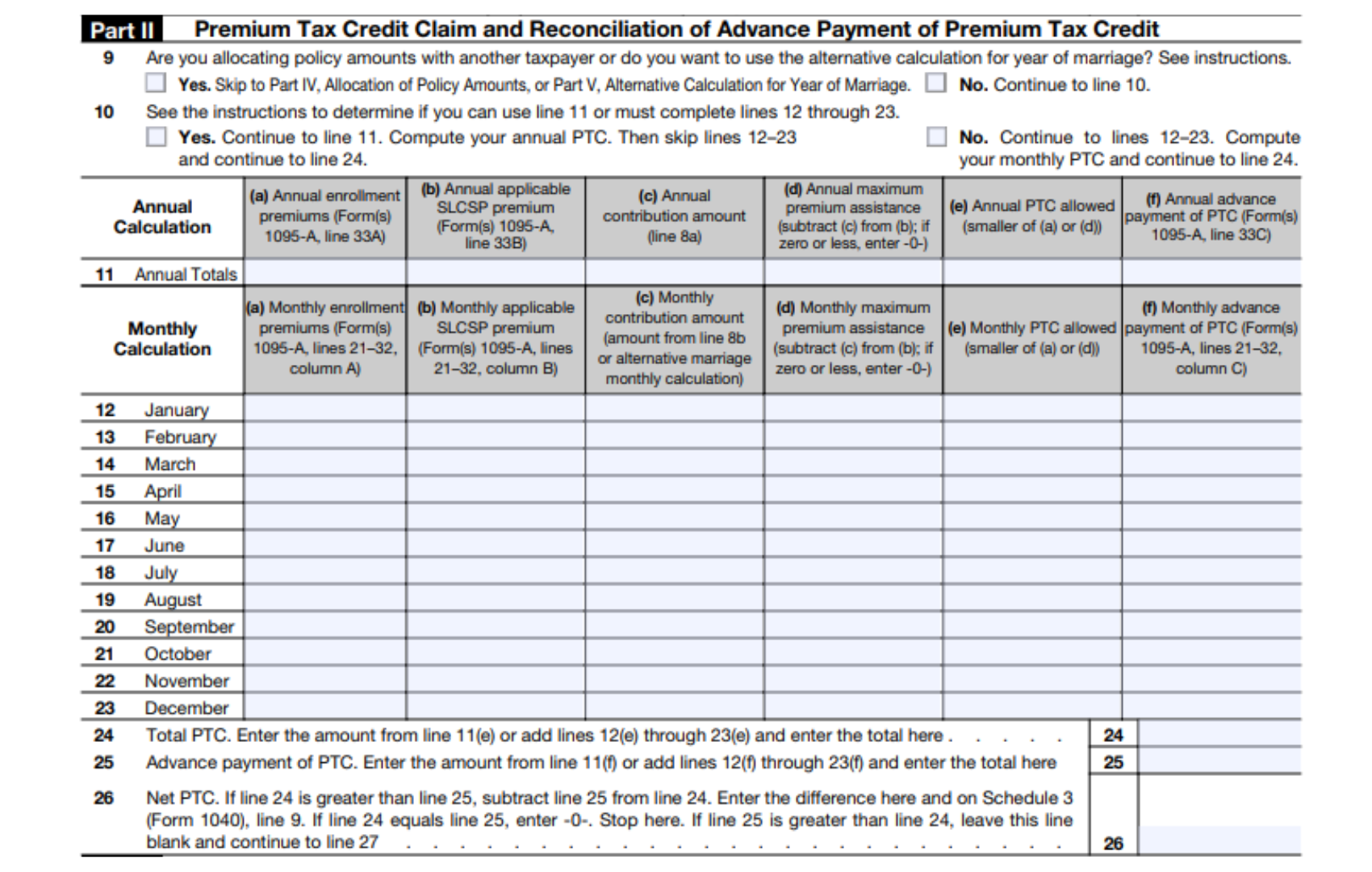

Part II of Form 8962. You will use part III of your 1095-A to fill out this section.

Print Form 8962 (PDF) and instructions (PDF).

Complete and file Form 8962 with your tax return.

-

-

- You will attach Form 8962 when you file your federal tax return. Keep your 1095-A for your records.

-

Click here to learn how to correct an electronically filed return rejected for missing Form 8962.

For help filling out Form 8962 or submitting your tax return, please contact an accountant, tax preparer, or visit www.irs.gov.