The Four Tier Levels for Health Insurance Plans

When exploring health insurance plans with Your Health Idaho, you will notice they are split into tier levels: Platinum, Gold, Silver, and Bronze. While it may be tempting to choose the cheapest plan and call it a day, it is crucial to understand which tier level best suits your needs.

Bronze plans are known for having the lowest monthly premium, making them an attractive choice for those who want to protect themselves from worst-case medical scenarios. While the upfront premium amount can look enticing, Bronze plans generally come with a higher out-of-pocket cost. This means that if you need more routine care than anticipated, you may spend more with a Bronze plan than you would with a higher-tier-level plan. Because of this, if you are enrolled in or planning to enroll in a Bronze plan, you may want to consider upgrading to a Silver-tier level, which can be a more economical choice in the long run.

Why Choose a Silver-tier Plan?

Silver-tier plans offer a balanced approach with moderate monthly premiums and out-of-pocket costs. But what really sets Silver-tier plans apart is the unique savings opportunity it offers through Cost-Sharing Reductions.

How Do Cost-Sharing Reductions Work?

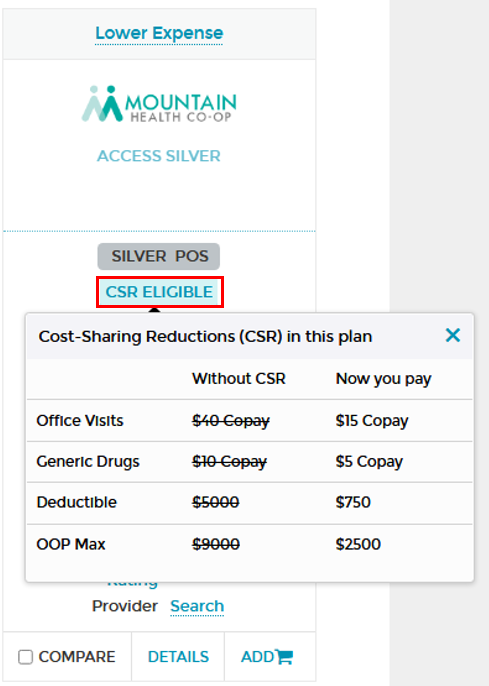

Cost-Sharing Reductions (CSRs) are available to individuals earning between 100% and 250% of the Federal Poverty Level. CSRs lower your deductibles, copayments, and coinsurance, allowing you to get more coverage for the same price—or even less—when compared to a Bronze plan. You can receive a CSR in addition to a tax credit if you are enrolled in a Silver-tier plan and qualify for the tax credit.

Example of savings

| Bronze Plan | Silver Plan with CSR |

| $50 Copay | $25 Copay |

| $17,800 Deductible | $5,000 Deductible |

| $18,900 Out-of-Pocket Maximum | $12,700 Out-of-Pocket Maximum |

Deciding which health insurance plan to choose requires careful consideration of your healthcare needs and financial situation. While Bronze plans may look appealing due to their low premiums, Silver plans may offer a balanced approach with the potential for substantial savings through Cost-Sharing Reductions. As you explore your options, it is important to evaluate what each plan offers and how it fits into your lifestyle.

How to Check Your CSR Options

- Fill out your household information on our pre-eligibility page.

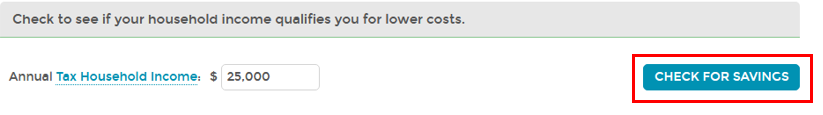

- Select Check for Savings to receive a tax credit estimate*

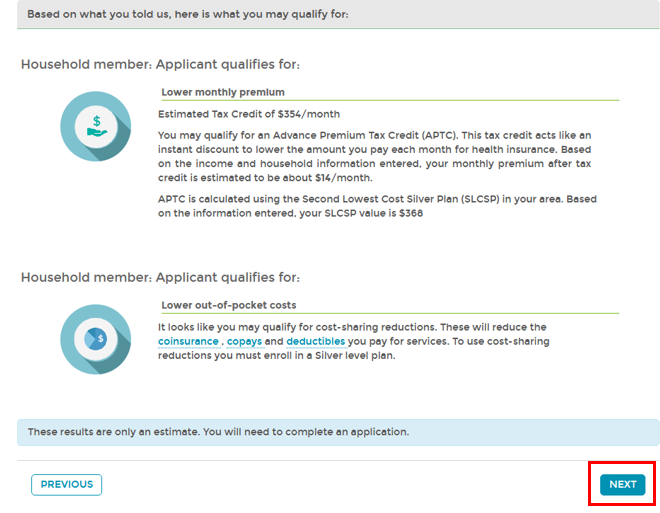

- Once you are taken to the tax estimate page, select Next.

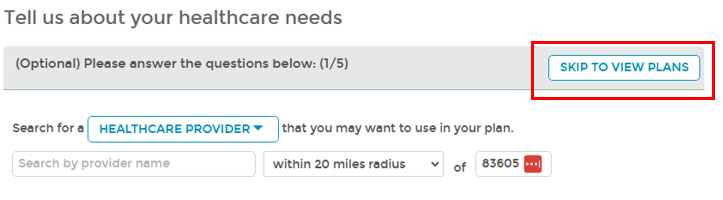

- You will be prompted to provide additional information about your healthcare needs. Provide your responses and click View Plans to continue or Select Skip to View Plans to opt out of this section.

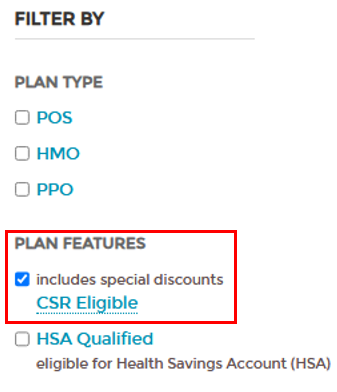

- Beneath the Filter By feature located on the left, and under Plan Features, select CSR eligible.

- After this selection, you will see which plans offer Cost-Sharing Reductions

- Click on CSR ELIGIBLE to see CSR savings

*Please note that your tax credit and CSR estimate is an approximation and may differ from the amount you qualify for.

No-Cost Assistance

Your Health Idaho-certified agents and brokers are available to help you navigate the world of health insurance, at no cost to you. To find an expert in your local area, visit our Find Help page.